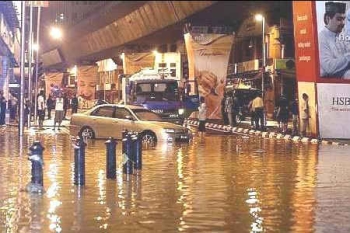

In my last blog post, I wrote about what you should do when driving your car over flood water. In today’s post, I‘ll be writing about car insurance particularly, who pays for water damages caused by flooding for your car. To put it simply, will the auto insurance company pay for your vehicle flood damage?

The answer to the above question is, unfortunately, NO! Not all insurance do. Only 1st Party or Comprehensive Policy.

My association with many mechanic friends over the years, have led me to understand some important things. They are, amongst other things:

i. For a car engine not to stall, the engine timing should ideally be more or less perfect.

ii. In manual driven vehicles, the ignition coil (in older mode) or the contact point should not come into contact with flooded waters. In newer vehicles, the above 2 parts are replaced by electronic starter units.

In short, it is contention and belief that as long as the above important parts are free from flood waters, you posses a very good chance of getting your vehicle across flooded waters.

Drivers and motorists, what must they do when they came across a flooded area?

In fact, there are 2 pertinent things that one should try to do. First is to get across a flooded area safely. Secondly, do not to allow one’s car engine to stall!

Next, we come to the hypothetical question of what if your vehicle should suffer from flooded waters? Will insurance coverage pay for the damage?

In reality, I am rather certain most Malaysian motorists or drivers do not know the answer to the above question. The Road transport Department or the Jabatan Pengangkutan Jalan (JPJ) makes it compulsory for all vehicles to be covered with Third Party or First Party (Comprehensive) risks before road taxes are issued.

I researched into the question of insurance coverage during floods, has led me to understand that a Comprehensive or 1st Party coverage is part of your automobile policy. And the good news is, your vehicle, which has been damaged by flood waters is therefore covered!

However, if unfortunately you are covered only by Third Party liability coverage, No, you’ll not be so lucky! In short, 3rd party insurance does not cover flood damages!

It is therefore no wonder, that if your car is under hire purchase financing, banks will always insist that your car is under comprehensive or 1st party insurance coverage.

In Malaysia, comprehensive insurance policies are slightly more expensive than 3rd party policies. Is the 1st party insurance premium worth your peace of mind?

You will have to think about it carefully. Then make a decision as to which type of risks you would like for your vehicle. If you have an older car, you may only want a 3rd party coverage for it.

What do you do if you are unfortunate to be involved in a flood or a storm?

The steps you are advised to take are as follows

i. Call your insurance agent immediately.

ii. Make an assessment of the damage.

iii. Take photos of your car.

iv. The above documents are extremely important

v. Do whatever you possibly can to comply with your insurer’s requirements.

In most cases, your insurance company will normally send an adjuster to your home or your workshop. If the damage to your car exceeds your car’s worth, then you can elect to take an option or payment. In Malaysia, this is known as Total Loss amongst insurance circles.

Is what is practiced in other countries, like England, Europe and America similar to those practiced in Malaysia? It is my contention and belief that the laws remain the same. After all, laws are laws. There shouldn’t be any differences or discrepancies.

However, to be on the safe side, I will look up my long time personal friend, a Mr. Ah Peng, 50, of Messrs Goh Brothers Insurance Agency in Klang to seek his opinion later.

So much for the question of flood damages in this article. By reading this short yet informative article, it is earnestly hoped readers of this blog will be better informed regarding flood damages.

Insurance claims are not the only problems a driver faces should he be caught in a flood. Your vehicle will most probably incur a few mechanical problems as well.

Leave A Comment